Netflix's Trillion-Dollar Ambitions, Tesla's Price Target Cut, Nvidia's China Troubles

Stay ahead of the stock market with a roundup of market-moving news, everyday.

️BTC/USD: $87,655.33 (+2.98%)

S&P 500: $5,146.02 (-2.59%)

️U.S. 10-Year Treasury: 4.391% (+0.064)

VIX: $34.42 (+16.09%)

*Price data accurate as of 12:45 pm EST.

HighStrike’s Q2 Thesis

In the whirlwind following the 2024 election, market dynamics have swung dramatically, driven by irrational exuberance and a perception of bullish policies from Trump’s election, leading to unprecedented highs in major indices like ES, NQ, and DJI.

However, by Q1 2025, this bubble began to unravel dramatically, with key indices and cryptocurrencies like Bitcoin plunging as reality set in amidst tariff threats and disappointing earnings.

The narrative suggests that despite these setbacks, there’s a roadmap to recovery and potential prosperity if liquidity increases and government policies stabilize the market.

Shane Leather, in his invigorating discourse, invites readers to join him in navigating these turbulent times through the research delivered below, culminating in a strategy that aims to outperform in these challenging yet opportunistic conditions.

The Daily Update: Netflix reported a 12.5% revenue increase to $10.54 billion in Q1 2025 and aims for a $1 trillion market cap by 2030, focusing on subscriber growth, ad revenue, and expansion into markets like India and Brazil; Salesforce's stock was downgraded by DA Davidson from 'Neutral' to 'Underperform' with a reduced price target from $250 to $200, citing concerns that the company's focus on AI could detract from its core business operations; Barclays lowered Tesla's price target by 15% to $275, expressing doubts about the company's ability to meet 2025 unit volume growth targets and concerns over CEO Elon Musk's involvement with the Trump Administration; Nvidia is preparing for potential restrictions on its GeForce RTX 5090D graphics cards in China, advising partners to halt sales due to the card's AI acceleration capabilities amid ongoing trade tensions; Bank of Hawai'i Corporation exceeded market expectations in Q1 2025 with diluted earnings per share reaching $0.97 versus an anticipated $0.89, and declared a quarterly cash dividend of $0.70 per share.

This newsletter is powered by TradeZero.

With the SEC enforcing strict regulations on these securities, day traders need reliable solutions that comply with regulations without eroding their profit margins. Single Use Locates offer a streamlined, one-time solution for trading these high-regulation securities, offering a more budget-friendly alternative to Pre-Borrows (PB) while adhering to SEC guidelines.

TradeZero’s Single Use Locates provide a valuable solution for day traders seeking affordable, compliant, and flexible short-selling options.

Are Netflix’s Lofty Ambitions Grounded in Reality?

Big Tech taught us that governing structures like centralization and the network effect. Netflix certainly fits the bill.

Salesforce’s Stock Gets a Downgrade Amid Concerns Over Misdirected AI Focus

Salesforce's strategic focus on AI has led to a downgrade by DA Davidson, citing concerns over the impact on its core business.

Baclays Cuts Tesla’s PT by 15%, Doubts Firm’s Ability to Meet Growth Targets

Barclays has cut Tesla's price target due to concerns over fundamentals and CEO Elon Musk's political ties.

Nvidia Preps for Another Potential Sales Ban in China, Stock Dips

NVIDIA anticipates a potential sales ban on its GeForce RTX 5090D card in China due to trade tensions and AI export controls.

Bank of Hawai‘i Reports Strong Q1 Results, Beating Expectations

Bank of Hawai‘i Corporation surpassed market expectations in Q1 2025.

This newsletter was brought to you by HighStrike!

The following are some levels that HighStrike traders are currently watching. Continue reading to learn why these stocks are in focus and where they’re heading. You can join the HighStrike community to improve your trading skills and connect to 10,000+ traders.

Check out our Discord to see the full game plan for today.

ES levels to watch today:

Above:

5,347, 5,583 and 5,639 snow line

5,493 tree line

Below:

5,258 and 5,023 snow line

5,113 fire line

NQ levels to watch today:

Above:

18,180, 18,385 and 19,225 snow line

18,706 tree line

Below:

17,347 and 17,026 snow line

17,866 tree line

Check out the pre-market video for a detailed explanation of this trade and targets!

HighStrike is the fastest-growing community of retail traders on the planet. The community’s 10,000+ traders from 142 countries gather on Discord daily, where HighStrike’s funded traders share live trade walkthroughs on video, answer questions from the community, vet trade ideas from members, and share their unique insights on the markets. It’s the new home for day traders.

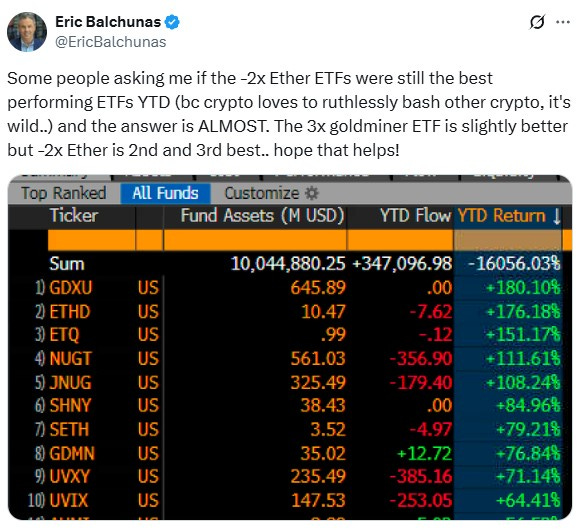

Tweet of the Day:

Disclaimer: The Tokenist does not provide financial advice. Please consult our website policy prior to making financial decisions.