Hasbro Shares Soar on Disney Deal, IBM Beats But Dips on DOGE Cuts

Stay ahead of the stock market with a roundup of market-moving news, everyday.

️BTC/USD: $93,558.45 (-0.10%)

S&P 500: $5,467.70 (+1.71%)

️U.S. 10-Year Treasury: 4.313% (-0.074)

VIX: $27.19 (-4.43%)

*Price data accurate as of 12:41 pm EST.

HighStrike’s Q2 Thesis

In the whirlwind following the 2024 election, market dynamics have swung dramatically, driven by irrational exuberance and a perception of bullish policies from Trump’s election, leading to unprecedented highs in major indices like ES, NQ, and DJI.

However, by Q1 2025, this bubble began to unravel, with key indices and cryptocurrencies like Bitcoin plunging as reality set in amidst tariff threats and disappointing earnings.

The narrative suggests that despite these setbacks, there’s a roadmap to recovery and potential prosperity if liquidity increases and government policies stabilize the market.

Shane Leather, in his invigorating discourse, invites readers to join him in navigating these turbulent times through the research delivered below, culminating in a strategy that aims to outperform in these challenging yet opportunistic conditions.

The Daily Update: Hasbro stock surged 16% after announcing expanded partnership with Disney securing global rights to Star Wars and Marvel franchises; IBM reported better-than-expected Q1 earnings with sales up 1% to $14.5 billion but revealed 15 federal contracts worth $100 million were canceled due to Musk's Department of Government Efficiency cuts, sending shares down premarket; President Trump's more conciliatory stance on China tariffs boosted market confidence; Dell Technologies and KLA Corporation present buying opportunities after 21% and 13% three-month declines respectively; meanwhile, Comcast lost 199,000 broadband subscribers (exceeding analyst expectations of 146,100 losses) and Fiserv missed revenue targets due to payments processing slowdown, causing their stocks to drop over 4% and 14%; Procter & Gamble and Merck both reported mixed results with P&G missing $20.36 billion revenue expectations with $19.8 billion, while Merck beat EPS forecasts despite 2% sales decline.

This newsletter is powered by TradeZero.

With the SEC enforcing strict regulations on these securities, day traders need reliable solutions that comply with regulations without eroding their profit margins. Single Use Locates offer a streamlined, one-time solution for trading these high-regulation securities, offering a more budget-friendly alternative to Pre-Borrows (PB) while adhering to SEC guidelines.

TradeZero’s Single Use Locates provide a valuable solution for day traders seeking affordable, compliant, and flexible short-selling options.

Hasbro Strengthens Ties with Disney, Stock Surges

Hasbro extends its strategic alliance with Disney, acquiring rights to Star Wars and Marvel franchises, aiming to deliver innovative play experiences and expand its product offerings.

Comcast, Fiserv See Stock Prices Dip Amid Challenges in Q1

Comcast and Fiserv faced significant financial challenges in Q1 2025, with Comcast losing broadband subscribers and Fiserv missing revenue estimates due to a slowdown in payments processing.

Two Stocks that Can Soar as “Worst Case” for Trade War Avoided

President Trump's bluff was called out and found wanting. But even as signals start to pour in, there is still space to capitalize from discounted stocks.

IBM Dips Despite Beating Q1 Earnings Amid DOGE Cuts

IBM posted earnings that exceeded expectations but faced headwinds as Musk's DOGE initiative cut 15 federal contracts worth $100 million.

Procter & Gamble’s Q3 FY’25 Results Fall Short of Expectations

Procter & Gamble's third-quarter results demonstrate slight growth in organic sales and earnings per share, while the company adjusts its outlook.

Merck & Co. (MRK) Reports Better than Expected Results for First-Quarter 2025

Merck's Q1 2025 results show a slight decrease in total sales but highlight growth in key segments.

This newsletter was brought to you by HighStrike!

The following are some levels that HighStrike traders are currently watching. Continue reading to learn why these stocks are in focus and where they’re heading. You can join the HighStrike community to improve your trading skills and connect to 10,000+ traders.

Check out our Discord to see the full game plan for today.

ES levels to watch today:

Above:

5,474 and 5,439 snow line

5,531.50 fire line

Below:

5,346 and 5,324.50 snow line|

5,289 and 5,381 tree line

NQ levels to watch today:

Above:

19,225 and 19,546 snow line

20,065 fire line

Below:

18,400 and 18,187 snow line

18,702 and 17,866 tree line

Check out the pre-market video for a detailed explanation of this trade and targets!

HighStrike is the fastest-growing community of retail traders on the planet. The community’s 10,000+ traders from 142 countries gather on Discord daily, where HighStrike’s funded traders share live trade walkthroughs on video, answer questions from the community, vet trade ideas from members, and share their unique insights on the markets. It’s the new home for day traders.

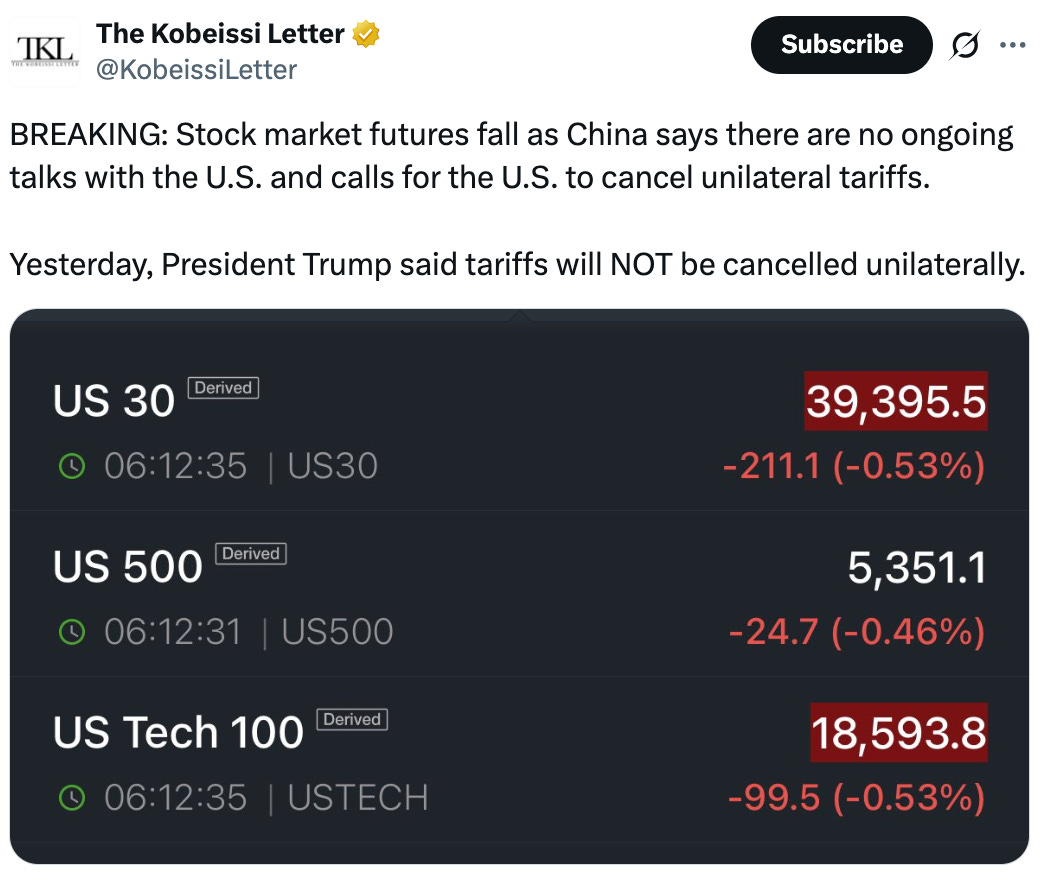

Tweet of the Day:

Disclaimer: The Tokenist does not provide financial advice. Please consult our website policy prior to making financial decisions.